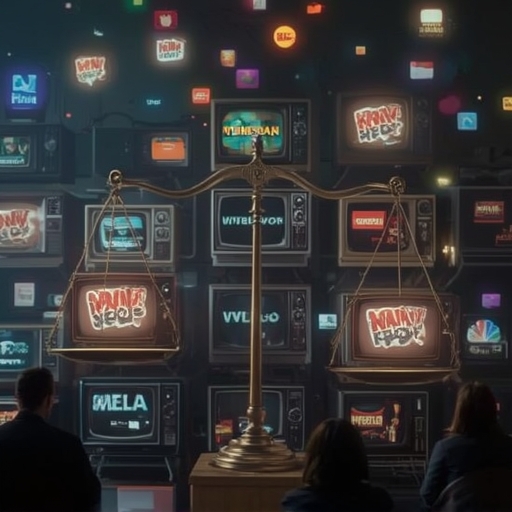

In a striking and somewhat paradoxical twist within the ever-evolving entertainment industry, Paramount—operating in partnership with Skydance—has assessed Warner Bros. Discovery’s television networks as having a total value of precisely zero dollars. Yet, despite this seemingly dismissive valuation, the same company is actively pursuing the acquisition of those very assets. This intriguing juxtaposition has reverberated across the media and finance sectors, prompting experts and observers alike to ponder whether this numerical verdict represents a deliberate strategic move or a subtle, meticulously calibrated negotiation tactic.

Such a valuation does not merely constitute a financial calculation; it also serves as a symbolic commentary on the broader state of traditional broadcast television in a market increasingly dominated by digital streaming platforms. The declaration that legacy networks possess no intrinsic monetary worth underscores a profound shift in the perception of value—away from conventional cable and satellite outlets and toward on-demand, subscription-based ecosystems. To many, it reflects the accelerating decline of linear TV viewership, with advertising revenues and subscriber counts steadily migrating toward robust digital competitors like Netflix, Disney+, and Paramount’s own streaming service.

Nevertheless, the timing of this assessment raises questions about its sincerity. By publicizing a valuation that places WBD’s extensive network portfolio at zero, Paramount may be attempting to gain leverage in ongoing or future deal negotiations. Assigning a deflated—or even nonexistent—value to the very properties it seeks to acquire could allow Paramount to strengthen its bargaining position, effectively justifying an offer far below what market analysts might otherwise expect. In corporate mergers and acquisitions, such psychological maneuvers are not unprecedented: signaling disinterest or devaluation is often used to drive down expectations before formal bids are placed.

Equally significant is the broader message conveyed to the marketplace. Paramount’s move serves as a case study in how major conglomerates reinterpret worth in an era where the term “content” extends far beyond networks, programming schedules, and legacy cable bundles. It speaks to a Darwinian transformation within the entertainment economy, in which adaptability, streaming infrastructure, and global digital presence now eclipse historical brand recognition as core indicators of long-term viability. The move places traditional networks not as cash-generating anchors but as potential liabilities requiring reinvention.

Whether driven by shrewd negotiation tactics, industry pessimism, or a calculated blend of both, Paramount’s pronouncement captures the essence of the media industry’s transitional identity crisis. As mergers redefine old hierarchies and investors scrutinize profitability over prestige, the declared “worthlessness” of WBD’s television properties paradoxically amplifies their symbolic importance. Their future—should a purchase materialize—could showcase whether the aging medium of broadcast television still contains untapped potential when repositioned in alignment with contemporary streaming models.

Ultimately, the spectacle of one media titan labeling another’s networks as valueless while simultaneously pursuing ownership encapsulates the surreal dynamics of modern media economics: perception, leverage, and digital ambition now weigh heavier than legacy status or market heritage. In this complex play between financial pragmatism and strategic theater, Paramount’s statement resonates less as a static valuation and more as a declaration of how profoundly the concept of value itself has evolved in the twenty-first-century entertainment landscape.

Sourse: https://www.businessinsider.com/paramount-wbd-cable-tv-networks-value-warner-bros-discovery-netflix-2026-1