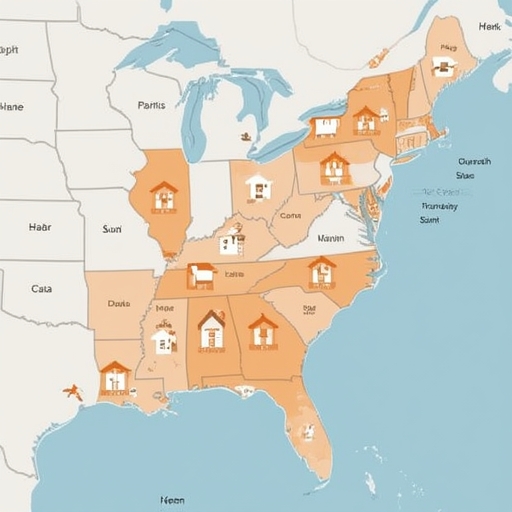

Across the landscape of the modern U.S. housing market, the influence of large institutional investors has become increasingly significant, even though they still represent only a relatively small fraction of overall homeownership. Their power is felt most profoundly in the segment of single-family rental properties, where corporate entities, private equity firms, and real estate investment trusts are fundamentally altering local housing dynamics. This growing presence is particularly evident in the Southeast and Sun Belt regions—areas such as Atlanta, Charlotte, Phoenix, and Tampa—where population growth, favorable climates, and comparatively affordable land have created ideal conditions for large-scale acquisition.

While on a national scale these organizations may own only a minor percentage of total housing stock, their strategic concentration of assets within specific metropolitan areas has led to a disproportionate impact on both renters and aspiring homeowners. In these markets, hundreds or even thousands of single-family homes are held under centralized corporate management, an arrangement that transforms what were once locally owned family residences into components of vast investment portfolios. This ownership model influences everything from neighborhood composition to price stability, as institutional investors often have both the capital and the analytic capability to outbid individual purchasers, streamline property turnover, and maximize rent yields with algorithmic precision.

The results can be double-edged. On one hand, institutional landlords can provide professionally maintained properties and consistent management practices that smaller owners may struggle to match. On the other, the concentration of such ownership tends to limit supply for first-time buyers and can accelerate the upward pressure on rents, thereby diminishing housing affordability. For middle-class families, particularly in rapidly growing urban areas of the Southeast and Sun Belt, these dynamics can mean fewer opportunities to purchase a home, longer periods renting, and greater financial vulnerability to market fluctuations.

Understanding where these mega-investors concentrate their holdings is therefore more than a matter of market curiosity—it is a key indicator of how accessible and equitable local housing conditions will be in the coming years. Examining city-level data reveals clear geographic trends: metropolitan hubs with robust employment opportunities, expanding infrastructure, and high inbound migration patterns have become the focal points for institutional capital. These locations illustrate how the broader forces of finance are now intertwined with community development, shaping not just neighborhoods but the very notion of homeownership in contemporary America.

In essence, the rise of institutional dominance in single-family rentals signals a transformation in the nation’s real estate ecosystem. What was once a domain defined by individual investment and family legacy is increasingly being reconfigured into a large-scale commercial enterprise governed by global market logic. As this trend continues to evolve, policymakers, residents, and investors alike must grapple with a pressing question: how can we balance the efficiency and resources of large investors with the urgent need to protect affordability, stability, and local ownership within America’s communities?

Sourse: https://www.businessinsider.com/institutional-investors-single-family-homes-cities-map-2026-1